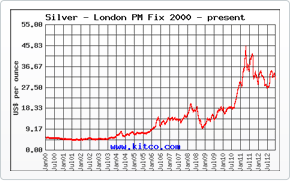

Precious metals did a lot this week but by the time markets closed there was little to nothing to show for it. Over the course of the past 5 days, gold more or less remained steady while silver actually took a bit of a beating. From an opening position of near $20/ounce, silver is going to finish the week much closer to the $19 mark. This is by no means a huge psychological blow to investors because silver is still sitting pretty as far as annual gains are concerned. In fact, where silver is sitting right now is barely more than a Dollar off its 52-week high.

FOMC Minutes Cause a Stir

One of this week’s biggest stories came on Wednesday in the form of the release of the minutes from the FOMC’s most recent meeting. Though there were very few people expecting to hear anything groundbreaking from the minutes, they were—as they always are—hawked over by investors the world over. Surprisingly, the minutes were not as straightforward as originally anticipated. In fact, the minutes showed that there were quite a few FOMC members who would have liked to see interest rates hiked in July.

The initial reaction to the minutes was that they were much more hawkish than expected and perhaps insinuated that further interest rate hikes might be happening at some point in the near future. However, a day later, when everyone had time to actually digest the data, it was then deemed to be more dovish than anything. The reason for this was due to the fact that even though the FOMC was clearly divided, the consensus was, overwhelmingly, that there needs to be more consistent, upbeat economic data across all sectors of the economy in order for rate hikes to be justified.

This simple fact means that we are not likely to see rate hikes anytime soon.

Other US Economic Data Dealt

Apart from the weekly jobless claims that is released each and every week, there was a report from the Philadelphia Federal Reserve which showed that the manufacturing sector of the US economy is improving steadily. The manufacturing sector has long been the source of inconsistent data, and investors are hoping that this is the first of many positive reports to come streaming in.

Finally, there was the weekly jobless claims data that everyone had to contend with. After a few consecutive weeks of upbeat data, consensus forecasts were for this week to show a rise in first-time jobless claims. Expectations were for the seasonally-adjusted average number of jobless claims to tick back upwards towards 270,000, however that did not prove to be the case. Officially, last week saw 4,000 fewer first-time claims for unemployment benefits than the week before. This brought the seasonally-adjusted average number of claims down to 262,000 and gave investors more reason to believe that employment in the US is upbeat and will likely remain that way.

For gold and silver, this was not the best news that could have been dealt. With that being said, the USD Index has spent much of the last month in a slump and that is actively aiding the prospects of precious metals. If the USD Index’s slump is doing nothing else, it is helping keep precious metals in their elevated positions. Even though it may seem as though the past few weeks have emitted nothing but losses for gold and silver, the fact of the matter is that both metals are sitting just below yearly highs, and are thought to have a lot of upside potential between now and the end of the year.